- Top Categories

- Economy

- Personal Finance

- Fintech

TikTok Deal Overshadows U.S.–China Trade Talks in Madrid as Tensions Escalate

High-level negotiations between the United States and China wrapped up in Madrid on Monday, with trade issues taking a back…

Trump Eyes New Fed Leadership as Scott Bessent Shapes Shortlist and Reform Agenda

The race to succeed Jerome Powell as Federal Reserve chair is gathering pace, with Treasury Secretary Scott Bessent now spearheading…

Why Your Morning Coffee Costs More: Climate Chaos, Tariffs, and Shrinking Supplies

Caffeine isn’t the only thing spiking in your cup lately — the price of coffee itself is climbing to record…

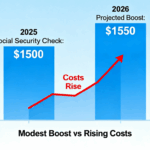

Retirement Savers Hit Record Highs as 401(k) and IRA Balances Surge

After a rocky start to the year, retirement savers are breathing a little easier. New…

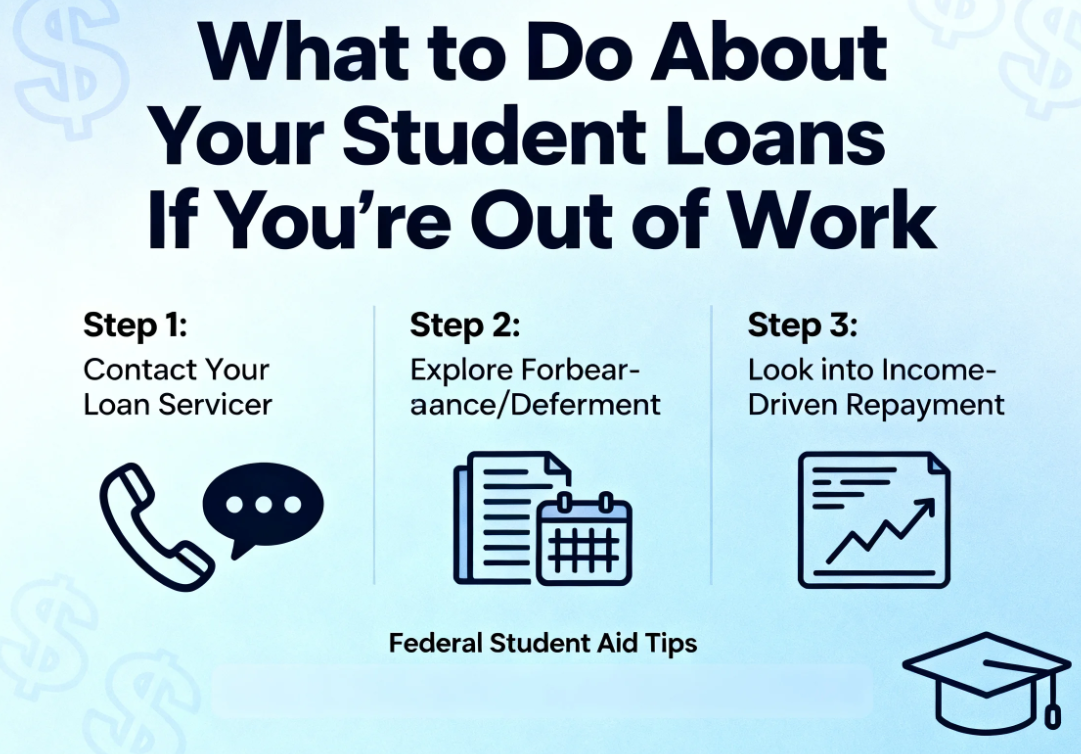

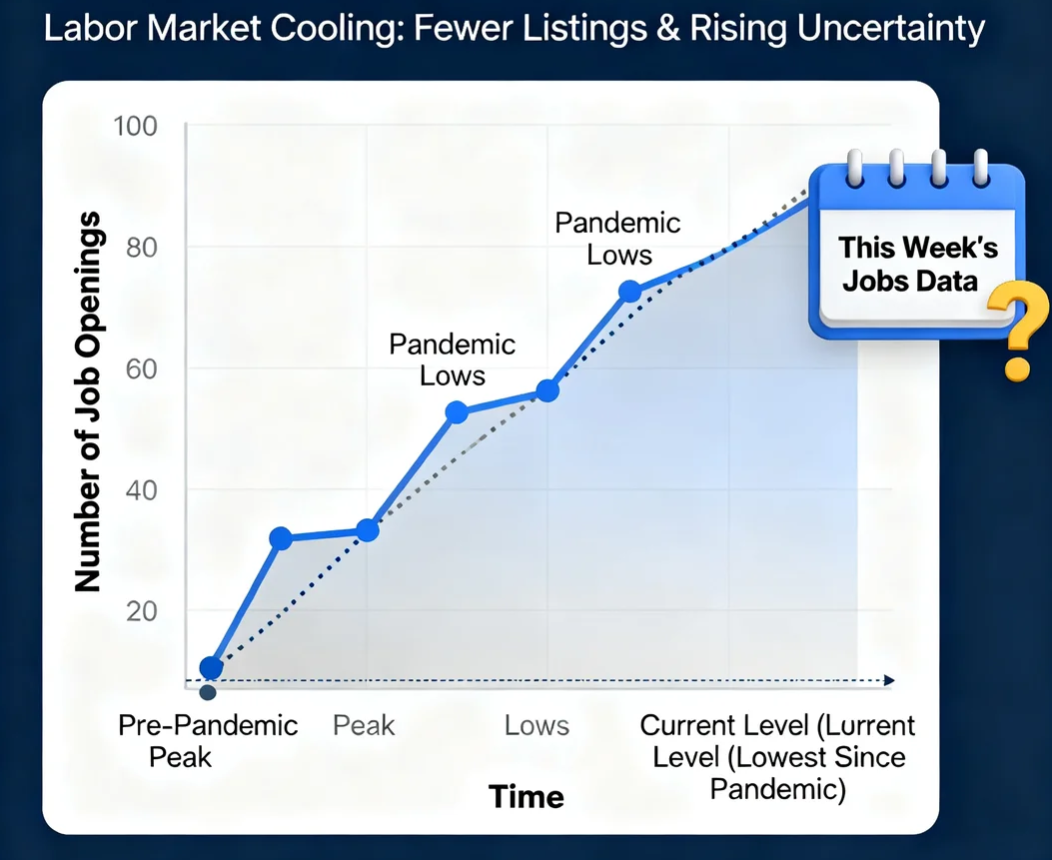

U.S. Job Openings Sink to Post-Pandemic Lows, Signaling a Fragile Labor Market

Job openings across the United States fell in July to levels rarely seen since the…

Walmart-Backed OnePay Launches $35 Unlimited Wireless Plan, Taking Aim at the ‘Super App’ Future

OnePay, the fintech startup majority-owned by Walmart, is expanding far beyond digital banking. Starting Wednesday,…

Denmark Cuts Growth Forecast as Novo Nordisk Faces Pressure from U.S. Tariffs and Weight-Loss Drug Competition

Denmark’s economic boom is losing momentum. On Friday, the government slashed its 2025 growth outlook…