Mortgage rates have been easing in recent months, dipping to a 10-month low in early August. While rates ticked slightly higher last week—the average 30-year fixed rate inching up to 6.68% from 6.67%, per Mortgage Bankers Association data—many homeowners are keeping a close eye on the Federal Reserve. If the Fed cuts rates this fall, refinancing could once again become a hot opportunity.

“Getting the preparation done beforehand will allow you to move quickly,” said Keith Gumbinger, vice president at mortgage site HSH.

Experts caution that the window to act could be brief. Mortgage rates often move in step with 10-year Treasury yields, which are sensitive to economic shifts. For homeowners with higher-rate loans, being ready before rates drop could mean the difference between saving thousands—or missing the chance entirely.

When Does Refinancing Make Sense?

Melissa Cohn, regional VP at William Raveis Mortgage, notes that it’s not enough for rates to drop a little—you need a meaningful difference. A common rule of thumb is at least a half-point (50 basis points) lower than your current rate, said Chen Zhao, head of economics research at Redfin.

“If you’re looking to refinance, especially in this type of interest rate climate, you need to be opportunistic, which means you probably need to move quickly,” added Gumbinger.

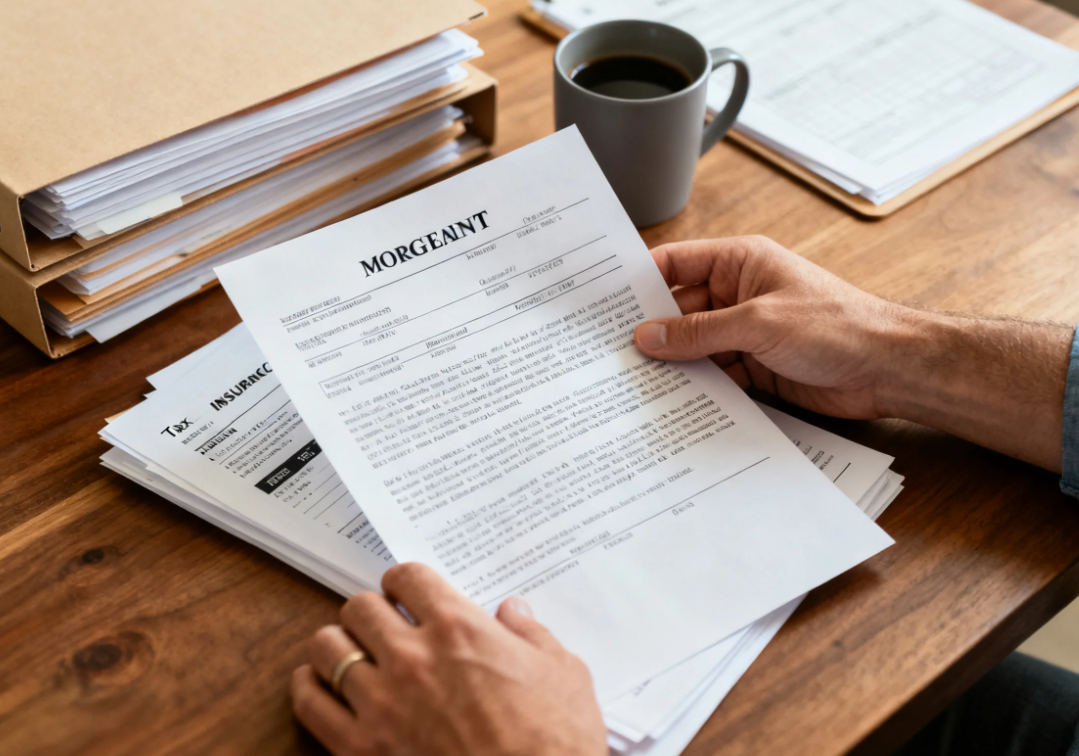

Five Steps to Prep for a Refinance

1. Review Your Credit Reports

Pull your reports from Equifax, Experian, and TransUnion via AnnualCreditReport.com. Lenders check all three, so accuracy matters. Spot an error? Dispute it early—fixes can take weeks.

2. Guard Your Credit Score

Your score is your golden ticket to better terms. Avoid opening new credit cards, taking on fresh debt, or making late payments. Big purchases you can’t immediately pay off could hurt your score right before you apply.

3. Check Your Home Equity

Equity matters. With at least 20% equity, lenders typically offer stronger terms. If you’re unsure where you stand, check recent sales in your neighborhood or talk to a real estate professional.

4. Gather Essential Documents

Streamline the process by having paperwork ready:

- Proof of income, assets, and homeowners insurance

- Your current mortgage statement

- Property deed and tax statement

- Two years of employment history

Also, set aside funds for upfront costs—expect $300–$500 for an appraisal and under $30 for a credit report.

5. Research Lenders in Advance

Don’t wait until the last second. Compare lenders now, learn about their terms, and keep a shortlist handy. Start with your current lender, which may offer a smoother process. Some lenders will even add you to a call list, alerting you when rates hit your target.

The Bottom Line

Refinancing isn’t just about timing—it’s about preparation. Rates can shift quickly, and by the time headlines announce a dip, the best deals may already be gone.

With the Fed’s September meeting looming, experts say the smartest move isn’t waiting—it’s getting your financial house in order now. That way, if the right opportunity comes, you’ll be ready to act.

“Just make sure there’s a big enough gap to make it worthwhile,” Gumbinger said. And if rates fall even further after you refinance? You can always do it again.