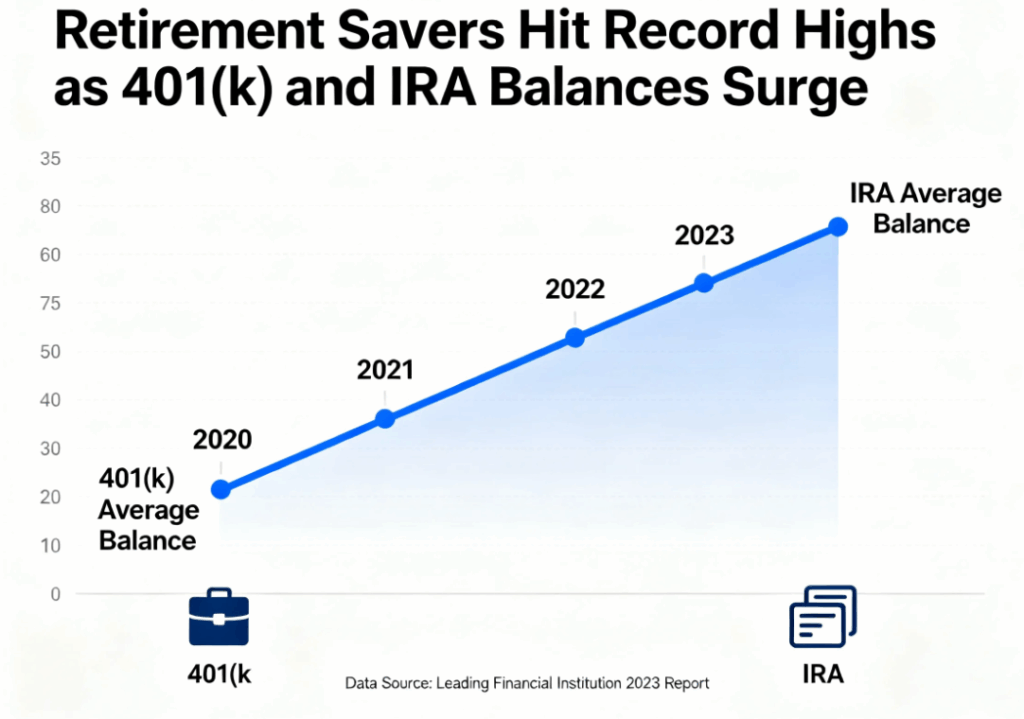

After a rocky start to the year, retirement savers are breathing a little easier. New data from Fidelity Investments, the nation’s largest 401(k) provider, shows that balances rebounded sharply in the second quarter, fueled by both strong market performance and steady saving habits.

The average 401(k) balance climbed to $137,800, an 8% increase from a year ago and the highest level on record. Meanwhile, the average IRA balance rose 5% year-over-year to $131,366.

Millionaire Accounts Break Records

The rebound has minted more retirement millionaires than ever before. Fidelity reported that:

- The number of 401(k) accounts with $1 million or more jumped 16% from the previous quarter, hitting 595,000.

- The number of IRA millionaires also rose 16%, reaching a record 501,481.

“This is a great reminder of the power of consistency,” said Mike Shamrell, Fidelity’s vice president of thought leadership. “Savers who continued contributing, even when markets dipped, are now reaping the benefits.”

Savers Stayed the Course

Despite the volatility triggered earlier this year by White House tariff announcements — which sent the S&P 500 to some of its worst trading days since the early days of Covid — most retirement savers didn’t panic.

The average 401(k) contribution rate, which combines employer and employee deposits, held steady at 14.2%, just shy of Fidelity’s recommended 15% target. That discipline, paired with the market rebound, set investors up for record growth.

As of mid-September:

- The S&P 500 is up about 10% year-to-date.

- The Nasdaq has gained more than 11%.

- The Dow Jones Industrial Average has advanced roughly 6%.

Long-Term Investors Are Winning

“Markets have shown remarkable resilience despite volatility,” said Tim Maurer, chief advisory officer at SignatureFD and a member of CNBC’s Financial Advisor Council. “And history tells us that any asset class with a positive rate of return will eventually hit new highs.”

The lesson? For retirement savers, the strategy remains simple but powerful: keep contributing, stay invested, and let the markets do their work over time.