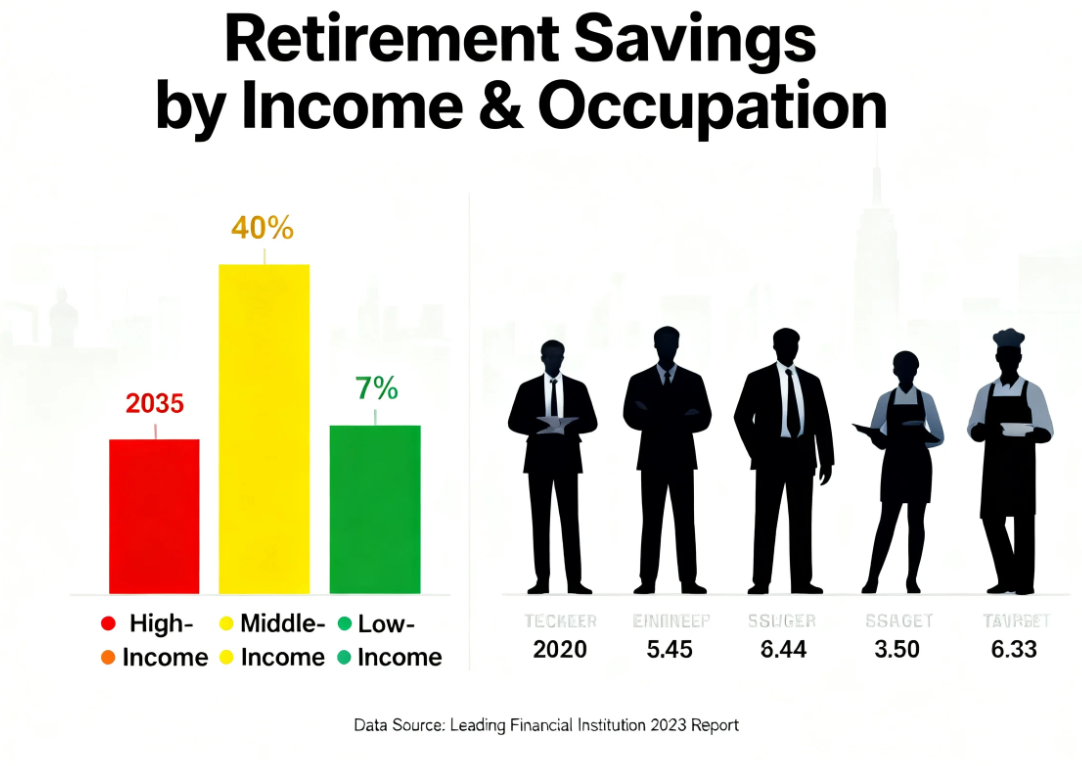

Losing a job is stressful enough — but if you’re one of the 40 million Americans with student debt, the weight of monthly payments can make unemployment feel even heavier.

The latest jobs report from the Bureau of Labor Statistics offered little comfort: just 22,000 jobs were added in August, far short of expectations, while the unemployment rate climbed to 4.3%, the highest in nearly four years.

“The slowdown in job creation might make some recent college graduates and borrowers worried,” said higher education analyst Mark Kantrowitz.

With more than $1.6 trillion in outstanding student loan debt, millions are wondering how to keep up with payments during a rough patch. Experts say there are options — but knowing the right ones can make all the difference.

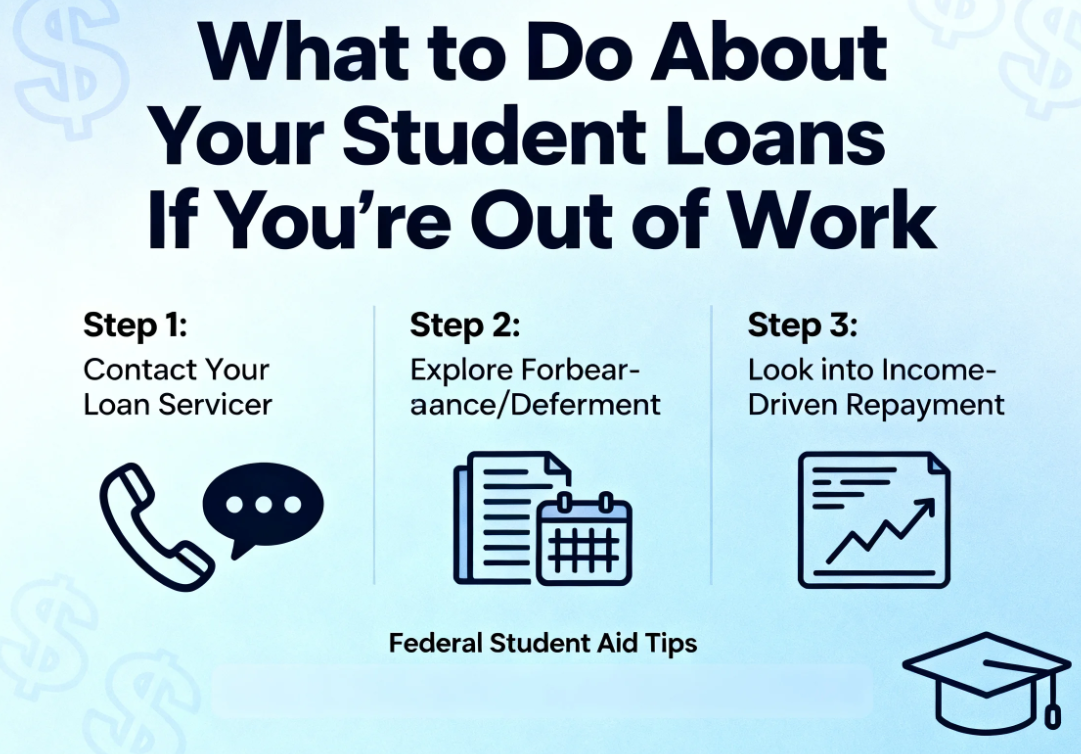

1. Apply for an Income-Driven Repayment Plan

If you’ve been laid off or your income has taken a hit, federal student loan borrowers may qualify for an income-driven repayment (IDR) plan. These programs tie monthly payments to a percentage of your discretionary income — sometimes lowering them to as little as $0 per month.

Unemployment benefits are factored into the formula, but IDR payments are still likely far lower than what you’d owe with a steady paycheck. And if your income has recently dropped, you don’t have to wait until next year’s tax filing: you can submit proof of your current earnings instead, said Nancy Nierman of New York’s Education Debt Consumer Assistance Program.

2. Pause Payments Through Deferment

Borrowers facing job loss may qualify for an Unemployment Deferment, which allows them to temporarily halt payments while actively seeking work or collecting unemployment benefits. Some loans will still accrue interest during this time, but others won’t.

There’s also the Economic Hardship Deferment, designed for those receiving public assistance or living on very low incomes. Usage of this option has doubled in just the past year, Kantrowitz noted.

Both deferment programs typically cap at three years over a borrower’s lifetime. Starting in July 2027, new student loan borrowers won’t have access to these deferments at all, though current borrowers will still qualify.

3. Consider Forbearance if Deferment Isn’t Available

If you don’t qualify for deferment, forbearance may be another way to pause payments. But here’s the catch: in most cases, interest will continue to add up, increasing your total balance when repayment restarts. To avoid ballooning debt, experts suggest covering at least the monthly interest if you can.

4. What If You Have Private Loans?

Relief options are more limited with private student loans. Still, experts advise being proactive: contact your lender as soon as you lose your job. Many private lenders have hardship programs or temporary payment relief, but you usually need to ask.

The Bottom Line

Being unemployed while carrying student loans can feel overwhelming, but you’re not without tools. Whether through an IDR plan, deferment, or a temporary pause from your lender, there are ways to ease the burden until you’re back on your feet.

“Even if your payment drops to zero, staying in touch with your loan servicer keeps you in good standing — and avoids bigger problems down the line,” said Kantrowitz.