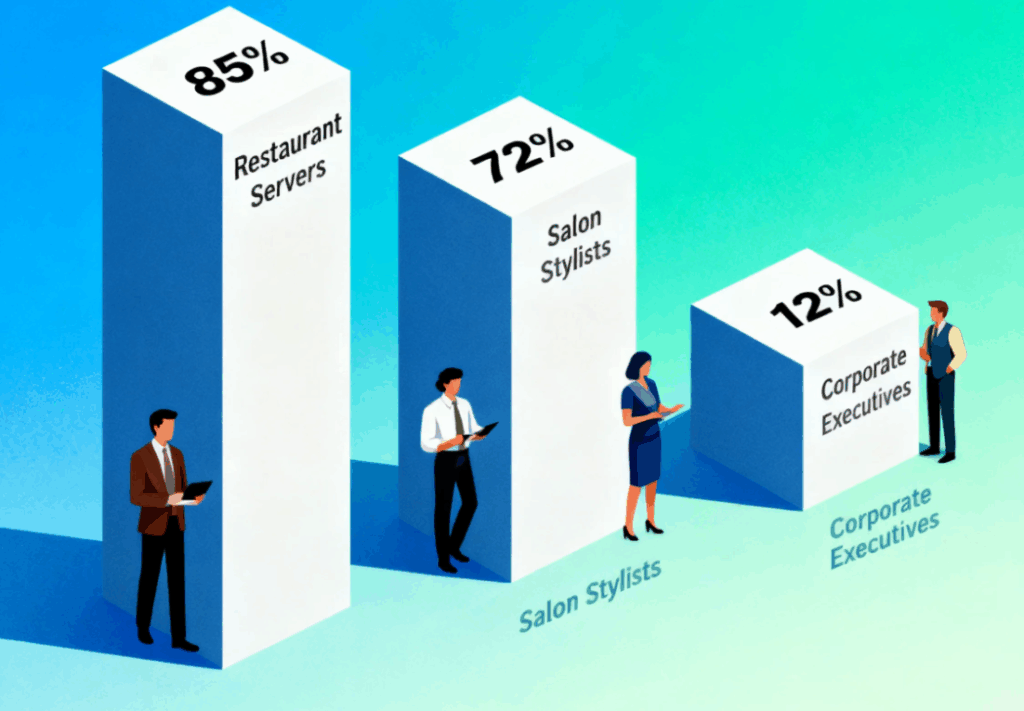

When the U.S. Treasury released its preliminary list of 68 tipped occupations in August, many workers cheered, thinking they’d soon cash in on President Donald Trump’s newly enacted “no tax on tips” provision. But experts warn the reality may be more complicated than it seems.

The tax break—passed as part of Republicans’ so-called “big beautiful bill” in July—lets eligible workers deduct up to $25,000 of qualified tips annually from 2025 through 2028. The benefit phases out once modified adjusted gross income climbs above $150,000.

On paper, the Treasury’s list covers jobs that “customarily and regularly received tips” before the end of 2024. But a second filter could keep some workers from qualifying: the rules barring certain “specified service trades or businesses” (SSTBs) from the deduction. These SSTBs—first defined in Trump’s 2017 tax law—include fields like healthcare, financial services, legal professions, and the performing arts.

The Hidden Catch

That second test means not every tipped job on Treasury’s list will qualify. “A lot of people will be surprised to find out that not every single occupation…is actually going to be eligible,” said Ben Henry-Moreland, a certified financial planner with Kitces.com.

Tax pros note the final rules could come down to context: how a person is employed and who they work for.

- Same role, different outcomes. A self-employed esthetician may qualify for the tax break since they aren’t providing medical services. But if the same esthetician works inside a dermatology office, their tips would likely be disqualified because they’re part of a healthcare SSTB.

- Performers face gray zones. A lounge singer hustling solo as a contractor could be blocked under the “performing arts” SSTB. Yet that same singer, if employed by a casino or restaurant, might get the deduction because the employer isn’t classified as an SSTB.

“It’s not going to be as clear-cut as people think,” said Thomas Gorczynski, a Tempe, Arizona-based enrolled agent. “The key will be how Treasury structures the regulations to navigate these complexities.”

Waiting for Clarity

The Treasury must finalize its occupation list by October 2, and tax professionals expect further guidance on how SSTB restrictions will be applied. For now, the uncertainty leaves many tipped workers unsure whether they’ll truly benefit.

One thing is certain: this tax break, marketed as a straightforward win for service workers, may end up drawing some complicated lines—dividing who qualifies and who doesn’t, even within the same occupation.