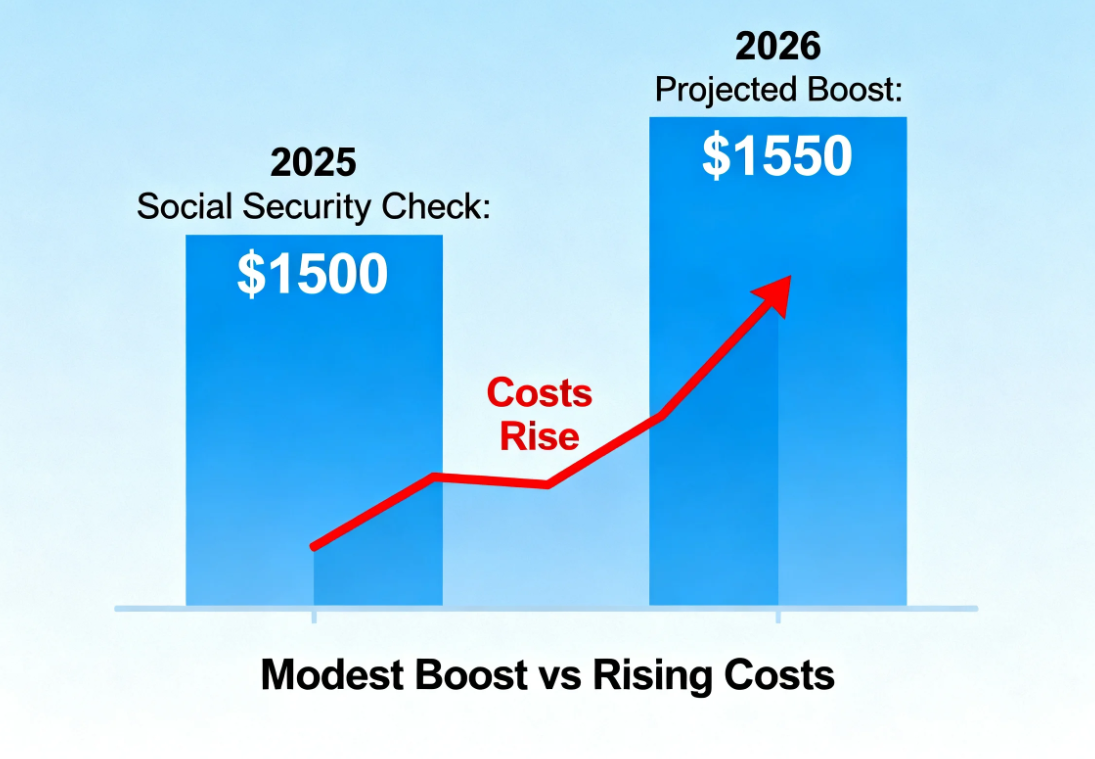

Millions of retirees may be in line for slightly bigger Social Security checks in 2026, though higher Medicare premiums and stubborn inflation threaten to eat away at much of the benefit.

Early estimates point to a 2.7% to 2.8% cost-of-living adjustment (COLA), according to projections based on the latest government inflation data. That would translate to an average increase of about $54 per month, nudging the typical retirement benefit from $1,955 to just over $2,000.

“Once September’s inflation data is included, the odds are very high that the COLA lands at 2.8%,” said Mary Johnson, an independent Social Security and Medicare analyst. “For it to be 2.7%, inflation would basically have to stall completely.”

The official COLA announcement is expected in October, when the Social Security Administration finalizes the adjustment based on third-quarter CPI-W data, a specific measure of consumer prices.

A Modest Increase Compared With Pandemic-Era Adjustments

If the estimates hold, the 2026 increase will top this year’s 2.5% bump, but fall far short of the pandemic-era highs when COLAs surged 5.9% in 2022 and 8.7% in 2023 as inflation soared.

That moderation reflects a cooler inflation environment. Yet many retirees say they still feel squeezed, particularly at the grocery store and the pharmacy counter.

Tariffs and Medicare Costs Cloud the Outlook

A new poll by the Nationwide Retirement Institute found that half of retirees are “terrified” that tariffs will fuel fresh inflation, eroding their already limited buying power. Nearly two-thirds believe future price hikes could easily outpace the COLA adjustment.

Adding to the strain, Medicare expenses are projected to climb sharply. The standard Part B premium may rise by $21.50 per month to $206.50 — nearly matching the steepest jump in the program’s history. Meanwhile, Part D prescription drug plans could see premiums climb as much as $50 per month in 2026.

Why Retirees Feel the Pinch

For retirees on fixed incomes, even small price shifts matter. “Inflation is particularly painful for seniors who rely on bonds or fixed income investments that don’t keep pace with rising costs,” said Jean-Pierre Aubry of Boston College’s Center for Retirement Research.

While homeowners with mortgages may benefit as inflation erodes debt balances in real terms, many retirees face the opposite problem: expenses rising faster than benefits. More than half of current Social Security recipients say they’ve already cut back on discretionary spending.

The Bigger Picture

Though COLAs are designed to preserve buying power, they lag behind real-time inflation since adjustments only take effect annually. Financial experts say retirees can lessen the impact by smoothing spending and seeking professional advice.

“Most people believe they can manage Social Security on their own,” said Tina Ambrozy of Nationwide. “But fewer than one in three are confident in their actual understanding of the program. A financial advisor can help retirees make smarter choices with both their benefits and their broader savings.”

For now, seniors can expect a little extra breathing room in 2026 — but whether that translates into real relief will depend heavily on what happens with inflation, tariffs, and health care costs in the year ahead.